Investors own nearly twice as much corporate debt (US$5.3T) today as they did in 2008. It’s not just institutional investors now. With the advent of the ETF the retail investor in search of a “safe, liquid asset” has gone into corporate bonds in a big way. But here is the killer. The same regime that gave us a decade of zero and negative real interest rate policies has also made regulatory changes that has resulted in bond dealers now holding an inventory of less than 1% of the US corporate debt inventory. While forcing the investor to go way out on the risk curve to make any income, at the same time all but eliminating the safety net. The willingness and ability of bond dealers to provide critical liquidity during a stressed market has fallen by more than 80%. (Source: Mauldin Economics Apr. 2018)

While expecting a liquid market in corporate bonds should volatility suddenly spike up, a retail ETF class of investor may be decidedly disappointed. 2018 has seen sharply curtailed liquidity during high volatility days when the stock market has dropped over 1%. This volatility may well become an issue if we see an inflation spike.

Exacerbating the problem is the ever-widening gap between US Federal Debt and US Treasury Holdings. The Congress passed a spending bill that raises the debt ceiling and Trump and the Republicans passed a truly historic tax cut at the same time. While this has the economy firing on all cylinders, it is forecast to increase the national debt another $1.4T for 2018. That is, of course, on top of the $10T debt increase run up by the last regime.

Someone must fund our deficit spending. But that is not going to be an easy task. Keep in mind that foreign central banks stopped net purchases of US government debt about five years ago. While the Fed and Treasury has forced the banks and money market funds to buy treasury bonds, that is not going to get the job done. Higher interest rates seems to be the next available option. Investors will lend money to the government if they get a high enough return. How high is that? No one knows for sure, but it won’t take much to further reduce bank lending activity and push the country into recession. Further, since the Treasury must turn to the private sector as a funding source, money that flows into treasuries is no longer available to other asset classes.

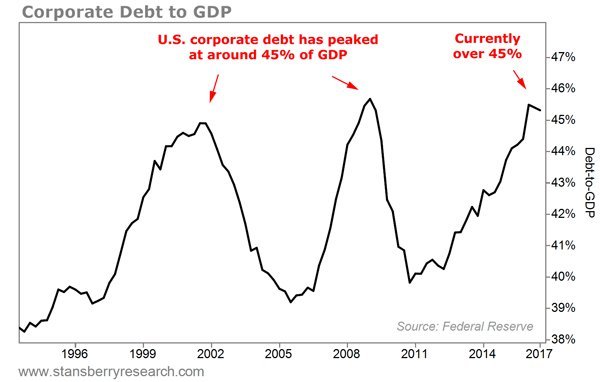

At the end of the day, the US corporate bond market appears to be an unstable investment. The size of the corporate bond market has nearly doubled since 2008 to US $5.3T. The corporate bond market faces a huge wall of maturities over the next five years. Over $700B in both 2018 and 2019 but then it ramps up to $1.2T in 2020 with over 40% deemed “speculative grade”. Many of these companies are over-leveraged and may suddenly find their debt service unsustainable. The “junk bond market” was created for, and has principally been confined to institutional type investors. ETF investors which currently have over US$300B in assets under management may find that they do not have the daily liquidity they were expecting.

Panic or bankruptcies in the corporate bond market would certainly be detrimental to the economy. This market may well be “the canary in the coal mine.” I’ll be watching it closely.

Managed Futures may be a great de-risking investment strategy when added to the standard stock and bond portfolio. As always, past performance of managed futures is not necessarily indicative of future results.

Tom Reavis

President

Worldwide Capital Strategies, LLC

The content of this article is based upon the research and opinions of Tom Reavis.