Investors, both retail and institutional, have portfolio diversification wrong and it could have disastrous results. With the best of intentions, today’s investor is mindfully building portfolios on the premise that diversifying capital across multiple asset classes will strengthen and shield it during adverse market conditions. It is important to recognize that diversification, as many understand it, is an antiquated approach to investing, that may not actually shield the investor as intended. To properly diversify a portfolio, it is important to separate capital allocation from risk allocation—they are not necessarily the same thing.

Most sophisticated investors realize that diversifying assets across fixed income, equities and non—traditional assets is a smart thing to do, when trying to protect the portfolio and prosper over the long term. However, a balanced asset allocation, even with a healthy mix of traditional and alternative assets, does not necessarily mean that a portfolio’s risk is diversified.

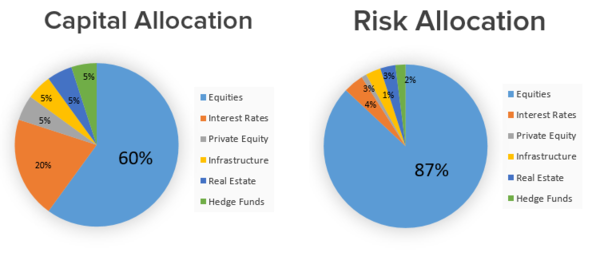

Since the stock market is now in the second longest bull market in history, it makes sense to assume that nearly any successful asset class that is being considered as an addition to an equities portfolio will have a very high correlation to the stock market. Statistically, it would be true. In fact, from 2006 through 2016 a portfolio of bonds, global real estate, hedge funds, private equity and infrastructure would have made and lost money at the same time as US equities 87% of the time. (BarclayHedge 2017)

The capital allocation model on the left is one that your investment advisor might have been very pleased to suggest for you. It includes 60% stocks, 20% bonds (less than normal because the Fed is on a program to systematically raise rates), and 5% each of traditional and popular non-traditional “alternatives”. Beautiful, right?! We are really diversified. That’s true but with the very high correlation of these popular “alternatives” to the stock market, what we are left with is a massive +87% bet on the stock market.

I would strongly suggest an allocation to the asset class that can make money in a bull market in equities but has consistently had a negative correlation to stocks when they are in a critical meltdown. That unique asset class is managed futures, not managed futures mutual funds, many of which have unsatisfactory returns, higher fees and lack of transparency. The majority of investment advisors and stock brokers aren’t licensed to sell or make money on separately managed futures accounts. Therefore, they often characterize them as opaque, complicated and risky. The opposite is true. Please contact us if you are interested in finding out how managed futures can lower the risk of your portfolio while offering the opportunity for greater gains.

Tom Reavis

President

Worldwide Capital Strategies

The content of this article is based upon the research and opinions of Tom Reavis.