I just got a call from one of my clients, “Hey, can you believe it? The stock market is up again today!” Yes, I can believe it and I’m excited about it. All too often over the last eight years, the market has gone up on horrible performance numbers by the economy. But, basis those bad numbers, investors knew that the Fed would not raise rates, that Janet Yellen and her accommodative Fed would continue printing money, buying securities and bonds and continue expanding the Fed’s balance sheet. That was putting stocks higher but for all the wrong reasons.

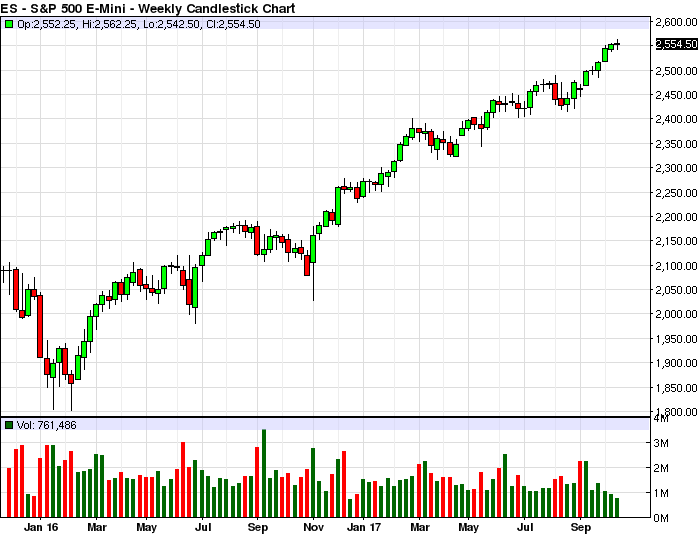

In contrast, the drivers of today’s stock market are an improvement in fundamental economic news. The third quarter was marked by solid corporate earnings, oil prices that surged nearly 30% and strong core capital goods orders.

Impressively, the current strong economic performance is broadly based. The economy seems to be firing on all cylinders with services, housing and even manufacturing expanding. Ten of eleven S&P sectors showed growth in the third quarter.

Americans have turned optimistic on their personal finances, the job market and the economy as a whole. Polls show the public plans to spend more as their income grows. Part of the optimism is undoubtedly coming from expectation of lower tax structure both corporate and personal. (Source: Bloomberg)

I find it encouraging that the growth is not just an American phenomenon. According to WSJ, 94% of countries globally are experiencing growth. China posted its fastest monthly manufacturing growth in six years. Europe and emerging markets have made impressive gains in every quarter of 2017.

The cost of the tragic fires in the west and hurricanes in the southeast, political gridlock, and specifically if Congress does not pass Trump’s tax reform bill, or a flare up of war in one the world’s many hot spots could negatively impact the economy but for right now it is refreshing to find positive reasons for the stock market moving higher. Those that like to sleep well at night should consider a 20% allocation to managed futures. For over forty years the addition of managed futures to the standard stock and bond portfolio has added liquidity and risk mitigation when investors needed it most. If you are interested in a free consultation on how managed futures may lower the risk and increase profitability of your portfolio, please call.

Best regards,

Tom Reavis

President

Worldwide Capital Strategies, LLC

The content of this article is based upon the research and opinions of Tom Reavis.