In the fall of 1970 I was fresh out of college. Because I had worked as a “runner”, carrying orders from the phone clerks to the brokers in the “pits”, I had developed enough connections to get a job as a commodity broker. I was thrilled when they gave me a desk next to the rising star in our company. He was not much older than I was, but in the short time that he had been with the firm he had gained quite a reputation as an excellent trader.

I watched his every move for months. He continued to be uncannily accurate in his trading but I could never figure out how he was making his trading decisions. I finally asked him what his secret was. “Oh, it’s very easy” he explained. “I park in the lot with the pit traders, it costs me a little more but it is well worth it. In my trading, I just follow the guys driving the big cars!” Ingenious!

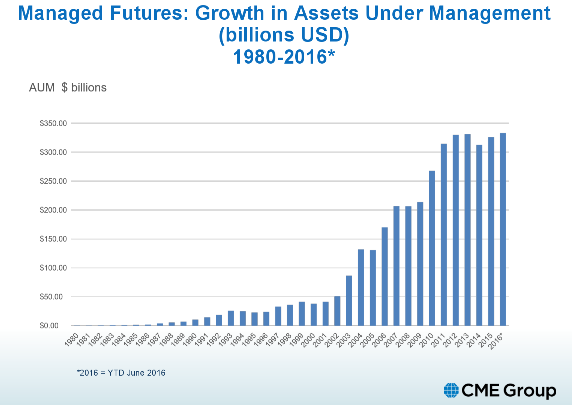

In today’s world, the guys “driving the big cars” are the hedge fund managers and they are increasing their exposure to managed futures in a big way. Inflows for the first quarter show increases of nearly $5 billion (source: BarclayHedge May 2017). At that pace net inflows for 2017 could exceed $20 billion, for a Y/Y increase of +94% (source CME).

Hedge fund managers site the specific role of trend-following strategies in the crisis risk offset portfolio (CRO). It is clearly for sudden downside protection but they also want positive returns during prolonged down-market periods. The appeal of trend-following strategies for hedge fund investors is their unique returns, which have a low correlation to long only strategies in equities, commodities, private equity, real estate, fixed income and other hedge funds (CME).

It should be noted that this huge influx of investment into the trend-following managed futures space has come despite generally poor performance over the last 18 months. Chris Solarz, managing director of global alternatives for Cliffwater, LLC says “conditions have not been favorable for systematic trend followers because signals have been muted because of prolonged quantitative easing that has created an artificial market condition.”

Institutional investors appear to be anticipating increased exposure to sharp, unexpected, lingering downturns, which is exactly the environment uniquely suited for systematic trend-following strategies.

Tom Reavis

President

Worldwide Capital Strategies

The content of this article is based upon the research and opinions of Tom Reavis.