The leveraged loan market is where companies whose credit is so weak, they can’t access the high-yield bond market to obtain financing. This is the “sub-prime” of the corporate bond market. In 2007-2008 sub-prime mortgages provided liquidity that accelerated the boom in real estate construction, real estate prices and the economy. However the system eventually became overloaded with supply, borrowers couldn’t make payments and defaults ensued. At the end of the day, sub-prime proved true to its name, junk.

Now, consider this. Today nearly one-third of the companies in the Russell 2000 Index are not profitable. They are living on debt made available by the trillions of dollars that have flowed into leveraged loan, high yield bonds and investment grade bond funds and ETFs. They are aptly called zombie corporations.

The popularity of leveraged loan funds and ETFs was enabled by zero interest rate policy. Savers and investors seeking to improve their returns have moved their money into riskier asset classes. One could certainly argue that any significant rate increase in high yield debt would make it more difficult for borrowers to pay, resulting in defaults jeopardizing hundreds of zombie corporations and by extension their employees. Not to mention all the investors chasing higher returns. Many of them are among the least able to sustain the loss. “The reality is precious few retail investors conceive of the ticking time bombs populating what they believe to be the safest slice of their portfolio pie” (Source: Bloomberg 4-2019). Consider that the high-yield bond market lost 45% of its value during the last financial crises.

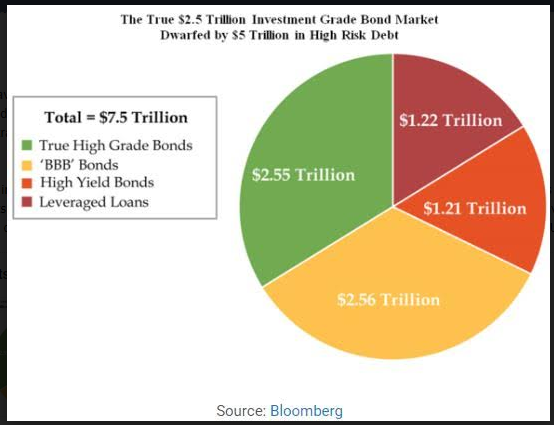

Part of the problem with contemplating the consequences of a bursting of the bond market bubble is the amount of money at risk. The total of $2.55 trillion in true investment grade bonds is dwarfed by $5 trillion in high risk debt. That includes $1.22 trillion in leveraged loans, $1.21 trillion in high yield bonds or junk bonds, and $2.56 trillion in BBB rated bonds which are just one rating measure higher than junk.

The Fed’s dovish turn in late March came after tremendous pressure from President Trump who was openly critical of the continued tightening and now is lobbying hard for a rate cut. A Fed rate cut when the economy is not in a recession is unheard of.

So, what does President Trump see in the economy that makes him want to reinstate the easy money policies of the last regime? Job growth numbers have been terrific for the last two years and GDP has jumped to 3.2% growth. Trump is describing the economy as “on fire!” These have historically been key indicators of a strong economy; however, other indicators have become increasingly worrisome. Wage growth, net worth numbers, auto loan delinquencies, workforce participation, the recent yield curve inversion and other indicators are signaling a potential slowing growth rate in front of us.

Perhaps most importantly, I believe that Trump is closely watching the high-risk bond market and you should too. It’s the “canary in the coal mine”.

There are ways to protect yourself and profit from a high-risk debt bubble. Please feel free to call for a no obligation consultation.

Tom Reavis

President

Worldwide Capital Strategies, LLC

The content of this article is based upon the research and opinions of Tom Reavis.