Today makes this the longest bull market in US history. It has lasted 3,453 days. The market in many ways is improving. While the recovery is still weak by historic standards, it is gaining momentum. 2018 has seen top line growth that has been all but missing for the last decade. What I mean is, companies are experiencing growth in gross sales or revenues as opposed to engineered profits from artificially low interest rates resulting in stock buy backs and cost cutting schemes. We are at full employment and the jobs that have been created are meaningful jobs that make for an improved standard of living. Manufacturing jobs and jobs for minorities have all increased. Latest data for June shows that personal income and personal consumption both increased by .04% in June. Consumers are earning and spending more. Larry Kudlow, Trump’s new economic Czar for the White House said Sunday morning on Meet the Press “the US economy is crushing it!”

The Fed “quantitative tightening” program has had little negative effect on the US economy, so far. All US stock indexes sit at or are very near record highs. Some argue that the economy is running too hot. The latest jobs report showed steady wage increases, which helped ease Fed concerns about inflation. (source CME Group) In spite of the Fed pushing interest rates steadily higher the EVRISI HOUSE Price Survey showed that home prices have remained remarkably steady. Mixed signals on inflation probably will not deter the Fed from raising rates in September. In fact, a CME survey shows a 93.6 % chance of a rate increase.

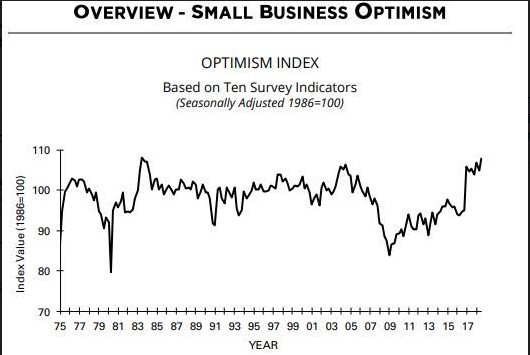

The NFIB survey of small business owners Optimism Index spiked higher after the election of Trump in November 2016 and this month tied the all-time record high made in 1983. Small business owners are important to the economic success of America. They create jobs, spend money on capital investments and develop innovative products that raise the standard of living. They are more likely to do these things when they feel confident.

The NFIB further reports that small business is having difficulty filling job positions with qualified workers. Which means that employers, nearly a decade after the recession ended, are finally willing to expand payrolls. They are doing this because they expect sales to grow beyond their present capacity to deliver. Not only are more people working but average hourly earnings are up 2.7% for the year and total hours worked has increased 2.2% in the last year.” As a result, total cash earnings are up

5% in the past year, more than enough to push consumer spending higher.” (Source: Mauldin-The Good News Economy)

Trump may have become his own worst enemy. He harshly criticized the Fed Chair Janet Yellen for politicizing her position by keeping rates too low for way too long, printing money to fund Dems entitlement programs, doubling the national debt and adding $4.5 Trillion to the Fed balance sheet. Trump brought in his own more hawkish Fed Board led by new Fed Chair Jerome Powell. This FOMC board has been slowly raising rates ¼ point increments. As discussed above, the economy is running hot. Perhaps too hot. In the last year through July the CPI increased 2.9%. The annual increase in the core CPI was +2.4%, the largest rise since September 2008. (Source: US Dept of Labor)

With the US raising rates, that is pushing the US$ higher against almost all other currencies. That makes US goods and services expensive against the Chinese Yuan for example, at a time when Trump is trying to pressure China in his trade war. In an interview last week with Reuters and in numerous tweets Trump said, “I should be given some support by the Fed”. With this more hawkish and autonomous FOMC board, I would not expect him to get it. This would go under the category of ”be careful what you wish for”.

With $22 Trillion in US debt, it would seem to me that our first priority would be guarding against any substantive rise in inflation from this level.

This is a delicate “Goldilocks” economy that could turn into the big bad bear quickly.

As with all my recent letters, I believe that you should stay in equities, but I strongly recommend lowering the risk to your portfolio with a judicious allotment to managed futures. As always, there is no guarantee that an allocation to managed futures will lower your risk or prevent losses. All smart investors hope for the best but prepare for the worst.

Tom Reavis

President

Worldwide Capital Strategies, LLC

The content of this article is based upon the research and opinions of Tom Reavis.