The London Financial Times defines a melt-up as a “dramatic and unexpected rise” in an asset class driven, as least in part, by a stampede of investors anxious not to miss out on the next move higher”, rather than an improvement in fundamentals. “Gains caused by melt-ups are usually followed quite quickly by melt downs.”

At least from this description, that is not what we are experiencing. Far from a “stampede”, last week’s volume for the composite indexes was the lowest average weekly volume of the year. Where one might expect a spike in volatility at new historic highs, instead we are seeing volatility at historic lows.

Veteran research analyst Edward Yardeni on CNCC’s “Futures Now” pointed out that the indices at this point aren’t being driven by a surge in valuation. Rather, it is more like a melt up in earnings.” And that is a bullish sign.

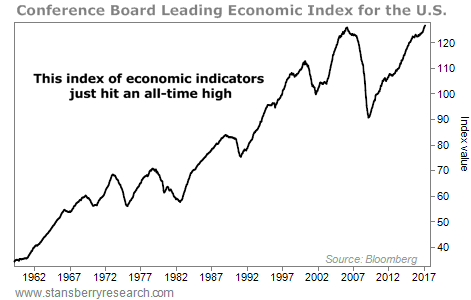

In the US, the last few weeks has seen an improvement in economic data. Gross domestic product readings are registering an up-tick and the manufacturing pace is the fastest in 13 years. And it is not just in the US either. It’s global. An improvement in economic data is evident in Japan, China and Europe.

General public optimism and specifically investor sentiment has improved substantially over the last month. Potential personal and corporate tax cuts are seen as a reason for the surge in optimism. While high optimism is, almost by definition, seen at market tops, current readings of 35% to 42% have historically been a bullish indicator.

If we are going into a melt-up, it is easy lending policies by the banks and a fed that is “behind the curve,” that may be the cause of it. You can count on “easy money Janet” Yellen to keep pumping money into the economy. Employment data and purchasing managers index are both at levels that are generally indicative of an overheated economy. Historically, readings this high have negatively impacted the S&P 500 in the next three to 12 months, as it signals the economy is running too hot.

Yardeni noted that “Historically, bull markets of this length and strength have a period of exuberance. It doesn’t have to happen but it usually does and we would certainly leave the door open for what is termed a melt-up.”

At Worldwide Capital Strategies we believe it may be prudent to stay invested in the current stock market if 20% of your portfolio or more is in managed futures which historically has consistently mitigated risk during market breaks. Nervous investors that are continually getting out of the market may miss out on another wave of big gains.

Tom Reavis

President

Worldwide Capital Strategies

The content of this article is based upon the research and opinions of Tom Reavis.